Equity

I. Instructions for registration of selling odd lot

Odd lot transactions are transactions with a volume of less than one trading unit. Odd lots usually arise due to dividends payment by shares bonus issues, share splits, or exercise the right offering.

These transactions take place on the Securities exchange or the over the counter market (OTC) through the negotiation and agreement mechanism between investors and securities companies.

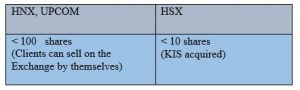

As a rule, the number of shares of each stock exchange:

- The first transaction day of the month

- Transaction price: 90% of the reference price

Method of transaction:

| Option 1: | Register to sell directly at the counter or call the hotline for instructions |

| Option 2: | Send registration information to email: ‘backoffice@kisvn.vn’ |

Includes full information:

– Full name, ID card information

– Number of securities trading accounts

– Number of securities need to be registered

II. Implementation of Right

What is an Ex-Right Date?

Ex-right date is the date on which the buyer will not enjoy related rights (right to receive dividends, rights to buy shares, rights to attend the general meeting of shareholders, …).

The purpose of this day is to close the list of current shareholders holding shares of the company.

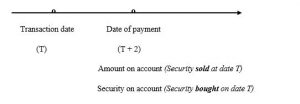

| For example | 6/11 | 07/11 | 08/11 | Businesses self-selected payment date | |

| T-2 | T-1 | T | … | ||

| Date of buying shares to be entitled rights | (ex-right date) | Final registration date (Closing date of shareholder list) | Date of payment |

What is shareholders’ right?

Rights that shareholders may receive including the right to receive dividends or the right to purchase additionally issued shares at preferential prices, the right to vote, and the right to contribute opinions about the company’s business operations. To help investors better understand the rights that shareholders may receive, please refer to the following article:

1. Dividend

When the company’s business is profitable, some of the profit is reinvested in the business and setting up reserve funds, the rest is paid to shareholders, called as dividends.

There are 2 forms of dividend payment:

Dividends payment in cash:

(Dividend payout ratio * Number of shares * 10,000) – Personal income tax (5%)

For example: Client A has 1,000 shares

Dividend payment ratio: 15%

=> Pre-tax dividend amount = (15% * 1,000 * 10,000) = VND 1,500,000

=> Post-tax dividend amount = 1,500,000 – 1,500,000 * 5% = VND 1,425,000

Dividends payment by shares

Instead of paying dividends in cash, the company will issue shares to shareholders. Issue of shares does not change the equity and the holding ratio of each shareholder in the company (by receiving the same proportion for the increase).

For example: Client A has 1,000 shares

Payment ratio 5: 1

=> The number of additional shares will be 200 new shares

2. Bonus shares:

Bonus shares are formed from the surplus of equity or other funds in the equity component.

There are 2 forms:

- In case of bonus for a certain group of people: Shares source is treasury shares

- In case of bonus for all shareholders of the company: will receive new shares at a certain rate.

For example: Client A has 1,000 shares

Payment ratio 5: 1

=> The number of additional shares will be 200 new shares

3. Stock rights

The right to purchase shares arises when the issuing organization issues additional shares to existing shareholders at the rate prescribed by the issuing organization.

Investors can exercise or not exercise the stock options. After the time of registration and payment, all rights will be canceled.

For example: Client A has 1,000 shares

Payment ratio 5: 1

Issue price: VND 10,000 / share

=> The number of additional shares to buy is 200 shares.

=> The total amount payable if taking the right

200 * 10,000 = VND 2,000,000

In case of not exercising the right to buy, the investor can transfer the right prescribed.

4. Right to attend the general meeting of shareholders, give written opinions

After having a list of investors owning securities on the last registration date, the issuing organization will base on this list to send letters of notice and guidance its shareholders to exercise the above rights.

III. Instructions for registering the right to buy

- Register directly on KPRO

- Register at the counter -KIS VIETNAM

-

Instructions for Depositing the right to purchase: (transfer money from any account to KIS’s Bank Account)

Content: Securities account number – Full name – Pay for the right to buy – Securities code (PILLED into account 00)

Example: 057FIB3456 – 00 – PARK YOUNG A – Pay for the right to buy ACB

*** TRANSFER OF PURCHASE RIGHTS

Customers wishing to transfer the right to buy, please sign Form 18 (3 copies)

Tiếng Việt

Tiếng Việt 普通话

普通话