Equity

I. Shares

What is share certificate?

Share certificate means a certificate issued by a joint stock company or a book entry confirming the lawful rights and interests of the investor.

The stockholder becomes a shareholder and at the same time is the owner of the issuing company.

Shareholders are the owners of the company’s capital and assets

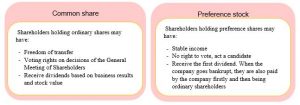

Types of share certificates

Normally, joint stock companies usually issue two types of shares:

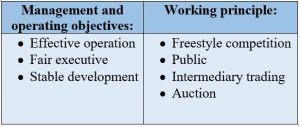

II. Securities Market

The stock market is the place where exchange, purchase, sale and transfer of securities are taking place, thereby changing the securities holder.

Market participants:

| ♦ Issuers | ♦ Investors | ♦ Business organizations in the Securities Market |

| These are organizations and agencies that perform the task of raising capital through the securities market. Issuers may be the Government, local authorities, corporate companies … | Investors here may be individuals or entities, businesses, organizations In particular, individual investors are divided into two types that investors accept risks and investors do not like risks. | Business organizations participating in the securities market: Securities companies, Securities investment funds, financial intermediaries, securities-related organizations, state management agencies, stock exchanges, securities computer service companies, etc. |

The structure of Securities/stock market

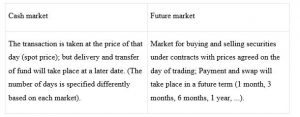

◊ Based on transaction method:

◊ Based on the nature of securities:

| Share market | Bond market | Derivative securities market |

| The market for purchase, sale and transfer of shares, in which shares certificates are known as the amount of money contributed by investors to the issuing company. They (shares) are issued by corporations or book entries confirming the ownership of one or a number of shares of that company. | The market for purchase, sale and transfer of bond, in which the bond is a certificate of debt obligations of the issuer paying for a specific sum of money (face value of bonds), for a defined period of time and with a specified revenue. | Including market of futures, option contract, … This is the high-end market for buying them selling and transferring high-end financial instruments; Therefore this market appears only in countries with advanced securities market development. |

◊ Based on capital flows:

| Primary market | Secondary market |

| Create channels to attract idle money to invest. | Create the ability to convert securities into cash easily and conveniently; Proceeds here does not belong to the issuer but to investors who sell securities, transfer the ownership of securities to other investors. |

⇒ Without the primary market, there is no security to circulate in the secondary market and vice versa; If there is no secondary market, it is difficult for the primary market to operate smoothly.

Tiếng Việt

Tiếng Việt 普通话

普通话