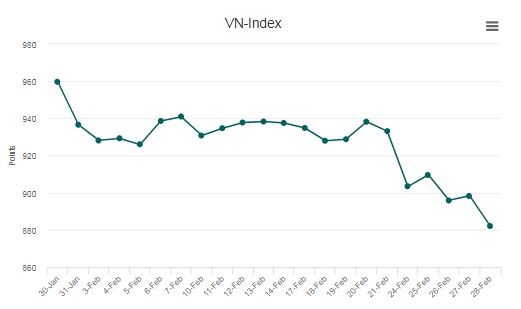

The VN-Index, which represents stocks on the Ho Chi Minh Stock Exchange (HoSE), Vietnam’s main bourse, has lost 5.45 percent since opening at 933.09 points Monday.

294 stocks fell and 81 rose on HoSE. Order-matched transactions surged to VND3.2 trillion ($139 million) from VND2.6 trillion ($112.92 million) last session, making Friday one of the busier trading sessions this month.

The VN30-Index for the bourse’s 30 biggest market caps fell even further at 1.93 percent, with 29 losing and only one gaining. Six stocks fell at least 4 percent this session, two of them in the construction sector.

ROS of real estate developer FLC Faros topped losses once again with 6.7 percent, almost hitting its floor price. The blue chip has been the most volatile VN30 stock, swinging from floor to ceiling prices for most sessions in the past month.

It was followed by SAB of Vietnam’s largest brewer Sabeco, down 6.5 percent, GAS of state-owned energy giant PetroVietnam Gas, with 4.1 percent.

Next were VPB of private mid-sized lender VPBank, which dropped 4.1 percent, and CTD of construction giant Coteccons, 4 percent.

Of Vietnam’s three biggest state-owned lenders by assets, BID of BIDV lost the most with 3.4 percent, followed by VCB of Vietcombank with 1.9 percent, and CTG of VietinBank with 1.7 percent.

The stock market’s two biggest market caps, VIC of private conglomerate Vingroup, and VHM of its real estate subsidiary Vinhomes, were two of the four better performing stocks this session, losing only 0.2 percent and 0.5 percent respectively.

PLX of state-owned petroleum distributor Petrolimex was the only ticker that gained, rising 0.8 percent.

Meanwhile, the HNX-Index for stocks on Hanoi Stock Exchange, Vietnam’s second main bourse for small and midcap stocks, surged 1.48 percent, and the UPCoM-Index for unlisted public companies shed 0.85 percent.

Foreign investors were net sellers for the 14th consecutive session on all three bourses, with a net sell value of VND410 billion ($17.788 million). Selling pressure was mostly focused on VNM of Vinamilk and VCB of Vietcombank.

Vietnam’s benchmark index mirrored movements in global and Asian equity markets, some of which are seeing their worst weeks since the 2008 financial crisis as the Covid-19 epidemic prompts investors worldwide to sell off shares.

The MSCI World Index was down 9.4 percent Friday, the worst performance since November 2008.

Japan’s Topix dropped 3.7 percent, Australia’s S&P/ASX 200 and South Korea’s Kospi both lost 3.3 percent.

China’s CSI 300 index of Shanghai Composite and Shenzhen Component-listed equities dropped 3.6 percent, and Hong Kong’s Hang Seng fell 2.4 percent.

Tiếng Việt

Tiếng Việt 普通话

普通话