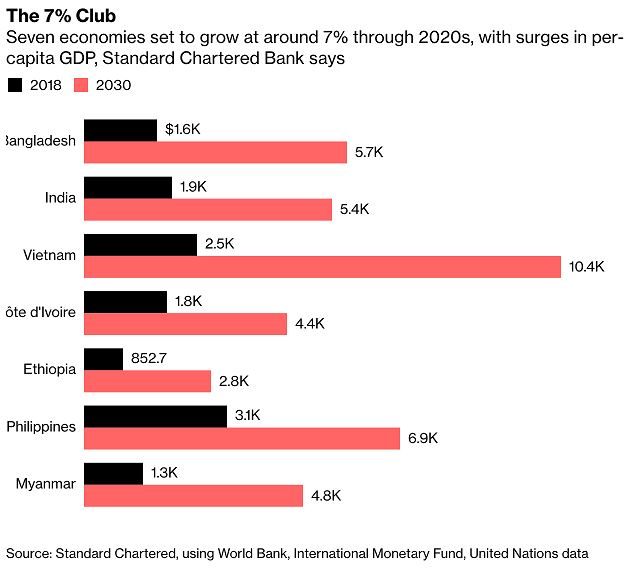

Vietnam is predicted to join an exclusive list of economies expected to sustain growth rate of around 7% during 2020s, translating into a 4-fold increase in the country’s capital income from US$2,500 in 2018 to US$10,400 by 2030, Bloomberg reported.

The information was revealed in a research note released on May 12 from Madhur Jha, Standard Chartered’s India-based head of thematic research, and Global Chief Economist David Mann.

Vietnam posted highest 10-year GDP growth of 7.08% in 2018, however, due to unfavorable global economic condition this year, international organizations including the World Bank, the Asian Development Bank (ADB), among others, projected the country’s economy to grow at 6.6 – 6.8% in 2019.

Other countries in the list included India, Bangladesh, Myanmar, the Philippines, Ethiopia and Cote d’Ivoire.

The South Asian members of the group should be GDP standouts as they’ll together account for about one-fifth of the world’s population by 2030, Standard Chartered reckons. The demographic dividend will be a boon for India, while Bangladesh’s investments in health and education should juice productivity.

The Asian dominance of the list is a change from 2010, when the bank first started tracking the economies it expected to grow by around 7%. Back then, there were 10 countries evenly split between Asia and Africa: China, India, Indonesia, Bangladesh, Vietnam, Nigeria, Ethiopia, Tanzania, Uganda, and Mozambique.

China is a notable absence from the latest ranking after being a member of the club for almost four decades — reflecting both a slowdown in economic growth and a progression toward higher per-capita incomes that makes faster growth rates more difficult to sustain. Standard Chartered estimates the world’s No. 2 economy will keep up a 5.5% economic growth pace in the 2020s.

“Faster growth not only helps to lift people more quickly out of absolute poverty, but is also usually accompanied by better health and education, as well as a wider range of — and better access to — goods and services,” they say in the report. “Higher incomes resulting from faster growth also usually reduce socio-political instability and make it easier to introduce structural reforms, creating a virtuous cycle.”

In addition, 7% club members tend to have savings and investment rates of at least 20-25% of GDP, according to the report.

Tiếng Việt

Tiếng Việt 普通话

普通话