The figure is mentioned in a recent report the ministry has submitted to the National Assembly, setting out the state of Vietnam’s debt and repayment plans.

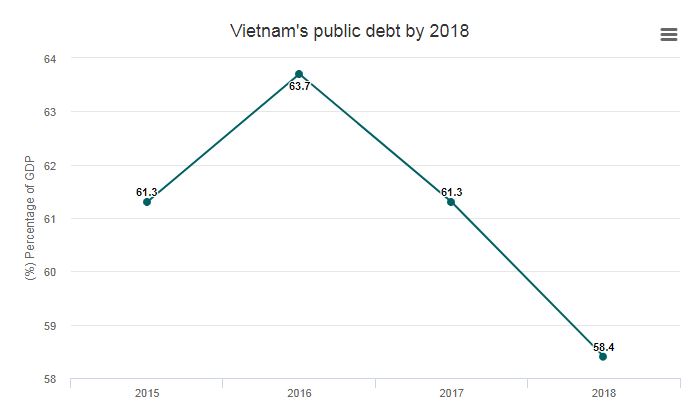

With public debt at 58.4 percent of Vietnam’s GDP, the country is well below the 63.9 percent target set by the Ministry of Planning and Investment last August.

According to the report, Vietnam’s GDP at the end of 2018 was approximately VND5.5 quadrillion ($213.67 billion). The ministry has estimated that each Vietnamese citizen carried a public debt burden of VND32 million ($1,367) as of last year.

The country’s public debt consists of central government debt, provincial government debt and loans guaranteed by the government.

Central government debt, which accounts for a major part of public debt, is equal to 50 percent of GDP last year, while government guarantees is equipvalent to 7.9 percent and provincial government debt 0.5 percent.

Minister of Finance Dinh Tien Dung had said at a conference last October that Vietnam’s public debt situation had eased, compared to 2-3 years earlier.

The ministry said it launched a series of measures last year to tighten Vietnam’s public debt, so that the scale of debt was minimized and its structure appropriate with market and foreign exchange conditions.

It reduced the amount of government bonds issued in 2018, lowered interest rates on the bonds and issued them at longer maturity periods to help reduce short-term repayment obligations.

By the end of 2018, 90 percent of Vietnam’s bonds had a maturity period of over 10 years, with the average maturity period for all bonds coming to 12.7 years.

Tiếng Việt

Tiếng Việt 普通话

普通话