The U.S. was Vietnam’s largest export market in the first five months with a value of $22.6 billion, up 28 percent year-on-year. China came second with $13.4 billion, down 2.6 percent, according to Vietnam’s General Statistics Office.

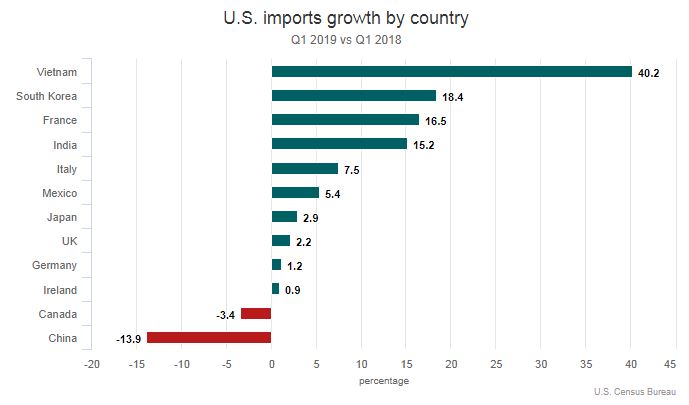

Vietnam was the U.S.’s 12th largest supplier last year, but if this pace of growth is sustained for a full year, it could leapfrog Italy, France, the U.K., and India in the ranks of top exporters to the U.S, Bloomberg said in a new report.

The country has become a standout in a region where the world’s export engines are largely hurting amid trade-war tensions and a slowing electronics cycle, the report added.

U.S. Census Bureau data shows Japan, South Korea, Singapore, and Taiwan all saw export contractions in April, while in the same month Vietnam’s exports gained 7.5 percent from a year earlier.

Experts have called Vietnam a “winner” of the trade war as it has received increasing investment as major manufacturers leave China to avoid the high tariffs.

U.S. footwear maker Brooks Running announced earlier this month that it would shift the majority of its shoe production from China to Vietnam this year.

Apple’s iPhone assembler Foxconn has acquired the right to use property in an industrial park in northern Vietnam, while Chinese GoerTek last year asked all suppliers involved in its AirPod production to ship all necessary materials to Vietnam.

Industry insiders have said that Vietnam’s low production costs have made it an attractive new home for foreign companies in China. A factory worker in Vietnam is paid half the remuneration of his counterpart in China. The geographical proximity between the two countries has made transitions easier and cheaper.

But there could also be negative fallout, according to analysts.

Economist Nguyen Tri Hieu told VnExpress International that the U.S.’s aggressive tariff raise means China has to depreciate its currency to mitigate the damage.

This would lead to a surge in cheaper imports from China, making it difficult for Vietnam’s domestic products to compete, he said.

The trade war between the world’s two largest economics intensified this month when U.S. President Donald Trump on May 10 raised tariffs on $200 billion worth of Chinese imports from 10 percent to 25 percent.

A day later he ordered a tariff hike on almost all the remaining imports worth $300 billion.

In response, China is set to impose higher tariffs on some $60 billion worth of U.S goods starting June 1.

Tiếng Việt

Tiếng Việt 普通话

普通话