A combination of factors spooked investors and caused the Dow to turn negative after starting the session in positive territory, including a decline in the 10-year Treasury yield to a record low and comments from health officials warning of a possible outbreak in the U.S.

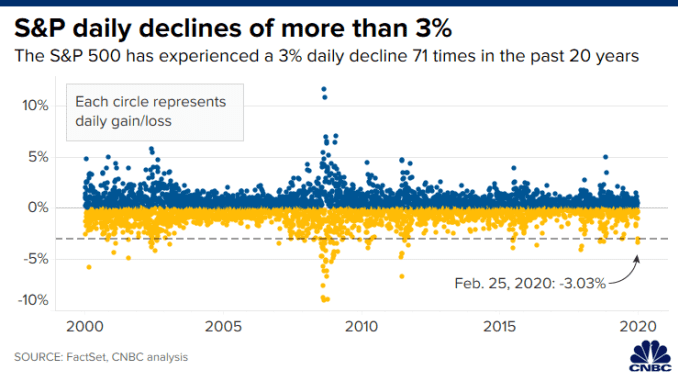

The Dow dropped 879.44 points, or 3.1%, to 27,081.36 after being up more than 180 points at one point shortly after the open. The benchmark posted back-to-back losses of at least 800 points for the first time ever. The S&P 500 slid 3% to 3,128.21, posting back-to-back declines of 3%. The Nasdaq Composite fell 2.8% to 8,965.61, and turned negative for the year. Monday’s session was the market’s worst in two years.

All in all, the S&P 500 lost $1.7 trillion in market value in two days, according to S&P Dow Jones Indices.

“Volatility is normal,” said Art Hogan, chief market strategist at National Securities. “What’s scary about this particular drop from the all-time high is it has snuck up on us so quickly in a short period of time.”

“When you juxtapose that against a mentality of ‘we don’t know how big this thing can get,’ that makes it feel like it’s a bottomless reaction in the market,” Hogan said.

These declines also put the Dow and S&P 500 about 8% below their record highs reached earlier this month. The Nasdaq closed 8.9% below its all-time high from Feb. 19. Technology stocks such Apple and Facebook have fallen into correction territory, down more than 10% from all-time highs hit just last month.

.1582664956861.jpeg?)

“I understand the inclination to buy on the dip. I understand that the path of least resistance in this market is to bounce up … but I stress, this is different,” Mohamed El-Erian, chief economic advisor at Allianz and former Pimco CEO, told CNBC’s “Squawk Box.”

‘This could be bad’

U.S. equities dropped as Centers for Disease Control and Prevention (CDC) officials briefed the U.S. on how to get ready if the coronavirus outbreak worsens domestically.

“We are asking the American public to work with us to prepare in the expectation that this could be bad,” Dr. Nancy Messonnier, a top official at CDC, told reporters on a conference call.

Stocks fell even as top White House economic advisor Larry Kudlow maintained that the coronavirus was contained so far in the U.S. and that economic growth had yet to be significantly affected.

Traders were unnerved by the bond market, which pointed to slower economic growth around the world. The 10-year Treasury yield traded at 1.33%, hitting an all-time low. The 30-year U.S. bond yield also reached a record low. Bond prices move inversely to yields.

“With global investors chasing after U.S. assets, specifically fixed income, there’s significant pressure on rates to stay low,” said Andrew Thrasher, founder of Thrasher Analytics. “This doesn’t mean we won’t see some countertrend moves in the 10-year, but the trend is well defined to the downside right now which is not one I’m overly eager to fight.”

The drop in yields pushed bank stocks down. Bank of America fell more than 5% while JPMorgan Chase closed 4.5% lower. Citigroup and Wells Fargo declined by 4.3% and 2.7%, respectively. Lower rates could hit bank profit margins.

Spreading outside of China

The market plunge on Tuesday came after investors fled stocks on Monday as a surge in coronavirus cases outside of China intensified fears of a prolonged global economic slowdown.

The Dow suffered its biggest point and percentage drop since February 2018 on Monday. The S&P 500 plunged 3.3%, also the worst drop in two years. With Monday’s declines, the S&P 500 and the Dow both wiped out all of their 2020 gains.

South Korean authorities have confirmed more than 900 cases within the country’s borders. Meanwhile, Italy has been the worst affected country outside of Asia, with more than 200 reported cases. Iran also confirmed at least 12 deaths.

The number of confirmed coronavirus cases in the U.S. remains small relative to other countries, but a strategist at Jefferies said that number could grow and further dampen investor sentiment.

“We increasingly find it hard to believe that USA cases are as low as reported, and believe that given the flow of Chinese, Korean and Iranian nationals into North America, a large USA community-based outbreak is increasingly likely,” wrote Simon Powell, equity strategist at Jefferies. “If not managed correctly, this could significantly rattle markets.”

Mastercard warned about the potential impact the coronavirus will have on 2020 results, sending its shares down more than 6%.

“The huge jump over the weekend to various other countries has many reassessing 2020 growth estimates,” said Ryan Detrick, senior market strategist at LPL Financial. “We could see quickly decreasing earnings and growth outlooks.”

Analysts have already begun cutting their earnings estimates for the first quarter. Data compiled by The Earnings Scout showed analysts expect S&P 500 earnings to contract by about 0.1% this quarter. Earlier this month, analysts expected growth of roughly 2.5%, the data showed.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Tiếng Việt

Tiếng Việt 普通话

普通话