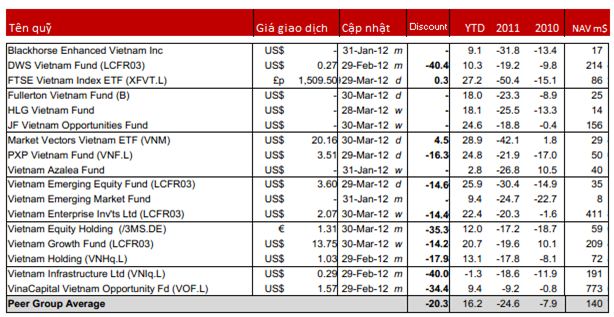

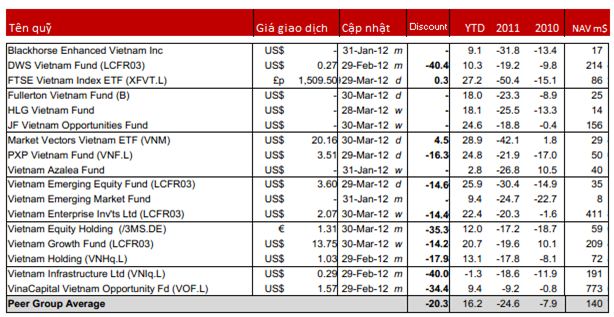

Two ETFs, Market Vectors Vietnam and FTSE Vietnam Index, posted biggest gains among the 17 funds, rising 29% and 27.2%, respectively. Following was PXP Vietnam and Vietnam Emerging Equity managed by PXPAM with gains of 25% and 26%, respectively.

Funds managed by Dragon Capital gained an average growth of 21% in Q1/2012, of which, VGF’s NAV rose 20.7% and VEIL grew 22.4%.

Funds run by VinaCapital posted less impressive performance with VOF added 9.4% and VNI fell 1.3% as of the end of February 2012.

These 17 funds’ shares were trading with an average discount ratio of 20.3% of their NAV. The biggest discount rate was seen in DWS Vietnam with 40.4%. The fund’s NAV saw 10.3% rise in the first two months of this year. This fund has NAV of $214 million, ranking third amongst 17 investment funds tracked by LCF Rothschild.

VOF run by VinaCapital had biggest NAV at $773 million, but its shares were being trading at high discount rate too.

Two funds of VEIL and VGF of Dragon Capital had NAVs at $411 million and $209 million. The total NAV of these 17 funds reached $2.4 billion.

List of 17 stock investment funds announced by LCF Rothschild

Other foreign investment funds are Fix Income and Private Equity (PE) with negligible NAV growth in Q1/2012.

Vietnam Property Holding Fund managed by Saigon AM fell 13% in the first three months of this year while four other real estate investment funds have not yet updated their NAVs with LCF Rothschild . The total value of these five real estate funds was $850 million VNL of which VinaCapital alone was $600 million.

In Q1/2012, VN Index of Hochiminh Stock Exchange (HoSE) gained 26.6%.

Tiếng Việt

Tiếng Việt 普通话

普通话