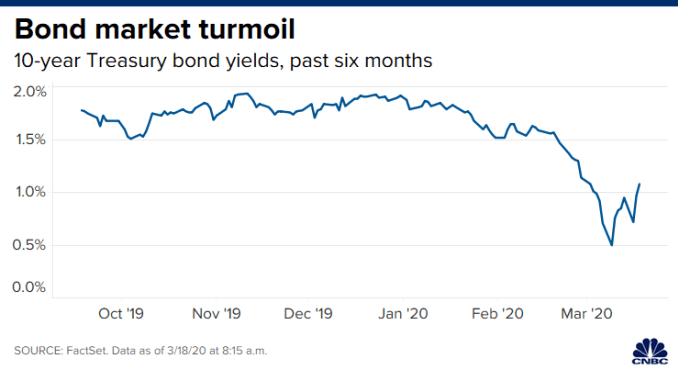

The yield on the benchmark 10-year Treasury note rose 12 basis points on Wednesday to 1.226% to reach its highest level since Feb. 28, extending its shocking reversal since Monday, when it traded at just 0.65%. The yield spiked 30 basis points on Tuesday as Treasury Secretary Steven Mnuchin worked with lawmakers to pass the massive stimulus plan.

The yield on the 30-year Treasury bond rose a similar 11 basis points on Wednesday to 1.684%. Bond yields rise as their prices fall.

Though many applauded the Trump administration’s effort to help prevent or ease the eventual impact of a recession, traders sold long-term bonds in anticipation of a deluge of future debt supply and the government’s eventual need to auction even more Treasurys. Any glut in debt supply could cause bond prices to fall and their yields to rise.

The rapid rise in yields also appeared to spook equity markets on Wednesday. Dow futures hit their “limit down” level in premarket trade Wednesday, then tumbled more than 4.5% in morning trading.

The flights from long-term debt this week came as the White House floated a historic fiscal stimulus package of more than $1 trillion designed to help boost a U.S. economy that many believe is on track for recession.

That sentiment was echoed by “bond king” Jeffrey Gundlach on Tuesday, who told investors he thinks there’s a 90% chance the United States will enter a recession before the year is over.

“When you decimate the restaurant industry, the travel industry, the hotel industry, the airline industry … the cruise line industry, obviously you’re going to take a huge divot out of economic activity,” the DoubleLine Capital CEO said during a webcast.

Gundlach also took aim at Secretary Mnuchin, who on Sunday said he was confident the economy would weather the downturn from the pandemic with the right amount of stimulus.

“Obviously we’re going to have a very substantial negative quarter,” Gundlach said. “I just couldn’t believe … that Secretary Mnuchin actually said he wasn’t sure we’re going to a recession as a result of this, we might actually avoid a recession. That just seems so ludicrous,” he said.

Gundlach said the U.S. could face a situation where the economy is weak yet yields rise as the costs to stimulate the economy increase. The bond trader said the stimulus could end up being even higher than $1 trillion.

Economists across Wall Street have warned that the coronavirus, and efforts to contain its spread, are liable to tip the U.S. economy into a recession in the first half of 2020 as employees work from home, refrain from travel or are otherwise unable to work.

Mnuchin told reporters that part of the Trump administration’s plan to offset a downturn could be to send checks directly to Americans in the next two weeks. An administration official said the package could include:

- $500 billion to $550 billion in direct payments or tax cuts

- $200 billion to $300 billion in small business assistance

- $50 billion to $100 billion in airline and industry relief

The Federal Reserve announced a series of measures aimed at bolstering liquidity in Wall Street’s funding markets and improving investor sentiment amid the outbreak.

Tiếng Việt

Tiếng Việt 普通话

普通话