Indeed, while other frontier markets have struggled out of the gates in 2012 (the MSCI Frontier Markets index is only up 2.8% compared with an 11% rise for the MSCI All-Country World Index), Vietnam ranks as a notable exception.

In fact, it’s one of the best performing stock markets in the world right now, with the Ho Chi Minh Stock index up 20.1% so far this year.

The good news? It’s not too late to capitalize on this opportunity. And here’s why you should…

Think Lower Risk, Not Higher

If Vietnam isn’t the first country that comes to mind when you think about investing in international markets, you’re not alone.

Most investors ignore it – and similar developing countries – because they’re labeled as frontier or “pre-emerging” markets. Such a classification is typically associated with higher risk.

I’ll be the first to concede that frontier markets typically do suffer from political instability, poor regulation, limited liquidity, volatile currency markets and weak financial reporting.

But over time these markets change, becoming more liquid and less risky. And many investors don’t realize that if we add exposure to frontier markets to our portfolio before these changes firmly take root, we benefit.

You see, frontier markets have a low correlation with developed markets, and thus serve as a portfolio diversifier. Meaning they end up reducing the overall risk of our portfolio, not increasing it.

Of course, my bold headline to buy Vietnam before it’s too late isn’t simply about adding some extra diversification to our portfolio. It’s about the fundamentals, too.

All the Economics Add Up

As Karim noted in his original analysis, Vietnam is one of the lowest-cost centers for Asian manufacturing. And that remains true today. Minimum salaries in Vietnam check-in at about $85 per month – compared with $173 in China – according to the United Nations’ International Labour Organization.

As a result, it’s inevitable that Vietnam is going to land more and more manufacturing jobs from China and U.S. companies like Intel Corp. (Nasdaq: INTC).

The country also benefits from a young population, with almost 50% of Vietnam’s 87 million people under the age of 25. So its workforce is more than capable of handling those new manufacturing jobs.

The latest news on the inflation front is encouraging, as well. For six months in a row, inflation’s been moderating. In February, it fell to 16.44%. And Dominic Scriven, Chief Executive Officer of Vietnam-based, Dragon Capital Group Ltd. predicts it could fall to as low as 8% this year. Which should open the door for Vietnam’s central bank to cut interest rates, thereby encouraging more economic growth.

Add it all up and Vietnam is indeed one of the top frontier markets for 2012. And based on the latest price action, it looks like investors are finally waking up to that reality.

But don’t let the increased attention scare you away. If we take a look at stock valuations, plenty more upside remains….

Still a Bargain by Any Measure

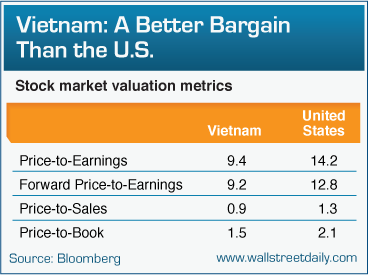

Earlier in the week, I noted that U.S. stocks, despite rallying some 24% since October 2011, are still cheap. It turns out that the same can be said about Vietnam. Truth is, even after a 20% run-up in 2012, Vietnamese stocks are still dirt-cheap.

Keep in mind, the last time frontier markets traded as cheaply as Vietnam does right now, they exploded higher, rising more than 50% in just three months. And that’s precisely why I believe if you don’t invest in Vietnam now, you could be sorry.

If you’re on board, the easiest way to invest is through the Market Vectors Vietnam ETF (NYSE: VNM). It gives you instant exposure to 34 leading Vietnamese companies. Plus, it carries a low expense ratio of 0.92%.

Bottom Line: Yes, the Dow (DIA) closed above 13,000 points this week – a level we last crossed in 2008 right before the financial crisis hit. Not to mention the S&P 500 (SPY) is off to its best start in two decades. But please, don’t let this strong performance tempt you into avoiding all other stock markets.

Remember, even when things are good at home, we need to be scouring the world for opportunities. And one country that should be at the top of your list right now is Vietnam. Before it’s too late.

Tiếng Việt

Tiếng Việt 普通话

普通话