Competition is set to intensify for Vietnam’s retail leasing market, mainly due to the entry of foreign players and the rise of e-commerce, stated Viet Dragon Securities Company (VDSC) in its latest report.

Japan’s giant retailer Aeon Group and South Korea’s Lotte Group are planning two large-scale projects in Ha Dong and Tay Ho districts in Hanoi. Aeon Group also aims to reach 20 shopping centers throughout Vietnam by 2025 and Lotte Group targets 87 new supermarkets by 2020.

Key e-commerce players in Vietnam are Chinese conglomerates, namely Alibaba Group with Lazada and Tencent Holdings with Shopee and Tiki. The American giant, Amazon, has officially entered the market by supporting Vietnamese small and medium enterprises (SMEs) through Fulfilment by Amazon (FBA) service. Amazon cooperated with Vietnam Post, one of leading Vietnamese logistics firms, to build a large-scale warehouse near Noi Bai International airport.

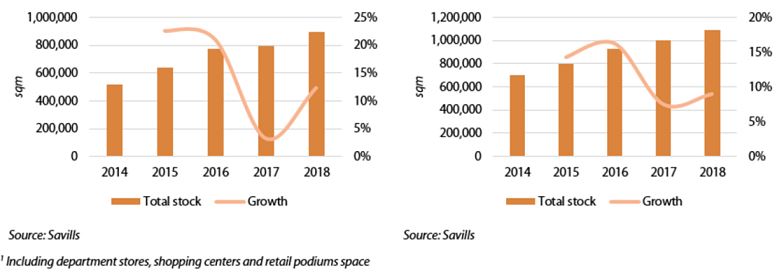

A recent Savills report updated the overall performance in retail leasing market in both key markets, including Hanoi and Ho Chi Minh City, posting average growth rates of 15% and 12% per annum, respectively.

A recent Savills report updated the overall performance in retail leasing market in both key markets, including Hanoi and Ho Chi Minh City, posting average growth rates of 15% and 12% per annum, respectively.

Rise of shopping malls

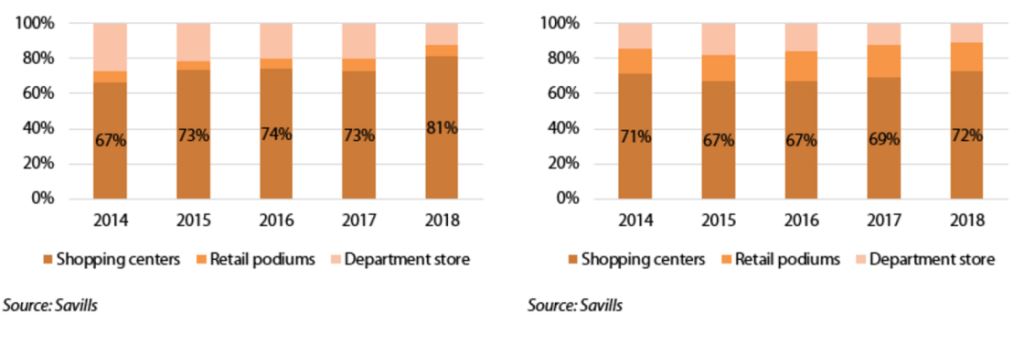

Moreover, there has been a growing trend of consumers switching from department stores to shopping malls.

Shopping malls had the greatest contribution to growth and market share over the years.

Total leasing space was over double in Ho Chi Minh and represented an impressive 50% in Hanoi compared to that of 2014. Malls also accounted for 81% share and 72% share in Ho Chi Minh and Hanoi, respectively, in term of leasing space.

Meanwhile, it is a different story for department stores. In Hanoi, the stock has remained unchanged for two recent years after closure of Parkson in December 2016. No new projects have entered the market since Aeon Mall in late-2015.

From 2014 to 2018, growth decreased by 6% per annum in Ho Chi Minh market due to limited new supply as well as closures of Parkson department stores.

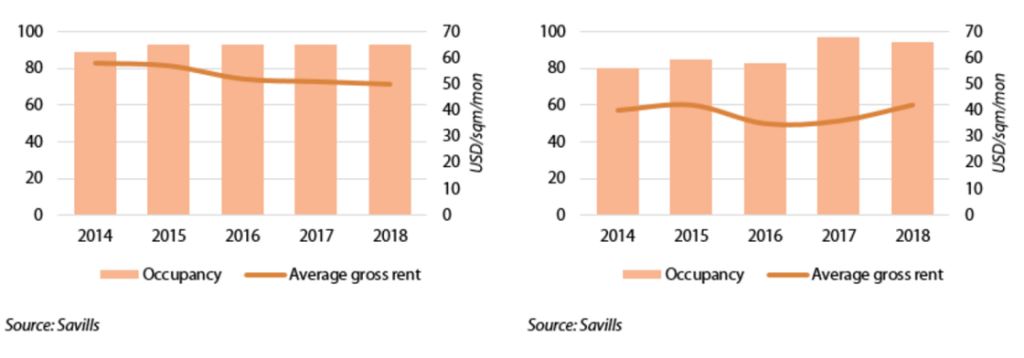

Additionally, the average gross rent in Ho Chi Minh City in 2018 was US$50/sqm/month, staying the same as of 2017, while the average occupancy reached 96% in the fourth quarter in 2018, increasing three percentage points quarter-on-quarter and year-on-year even after the entry of new supply, stated VDSC.

In Hanoi, the average gross rent has steadily increased throughout the year and continued its upward trend with surges of 3% quarter-on-quarter and 17% year-on-year to US$42/sqm/month. Average occupancy was 94%, down three percentage points quarter-on-quarter and four percentage points year-on-year.

Strong growth predicted

Strong growth predicted

Meanwhile, VDSC expected strong growth for the retail leasing market in both Hanoi and Ho Chi Minh City in 2019.

Evidently, there are 16 projects with a cumulative supply of 300,000 sq.m being scheduled to be launched in Hanoi in 2019. Vinhomes D’ Capitale and Aeon Mall Ha Dong are the most significant projects.

In Ho Chi Minh City, future supply in 2019 will be 250,000 sq.m net leasable area (NLA) from 16 projects, of which, Union Square is the only new project located in central business district (CBD) after a period under renovation. Future large scale non-CBD projects include Thaco Complex in District 2, The Mall in District 10, Aeon Mall Celadon Phase 2 in Tan Phu and Giga Mall in Thu Duc.

Most future projects will be located in residential and commercial areas with improvement of infrastructure and traffic network. Retail projects as components of residential complexes attract both tenants and shoppers because they take advantage of the potential customer base as well as provide residents with additional amenities.

Tiếng Việt

Tiếng Việt 普通话

普通话