The Dow Jones Industrial Average dropped 1,338.46 points, or 6.3% to 19,898.92, marking its first close below 20,000 since February 2017. The Dow was down more than 2,300 points at the lows of the session. The S&P 500 dropped 5.2% to 2,398.10 and closed nearly 30% below a record set last month. The Nasdaq Composite slid 4.7% to 6,989.84. Virtually no market was safe from the selling wave, with crude prices having their third-worst decline on record.

Stocks came off their lows in the final minutes of trading after the Senate obtained the votes to pass a coronavirus relief plan to expand paid leave.

Echoing concerns of the about the mounting economic impact of the virus and whether the government is doing enough to combat it, billionaire investor Bill Ackman said the best remedy for the market downturn and the outbreak in the U.S. is for President Donald Trump to shut down the country.

“We need to shut it down now… This is the only answer,” Ackman, founder of Pershing Square Capital Management, told CNBC’s “Halftime Report” on Wednesday. “America will end as we know it. I’m sorry to say so, unless we take this option.”

“Hell is coming,” said Ackman. “Capitalism does not work in an 18-month shutdown, capitalism can work in a 30-day shutdown.”

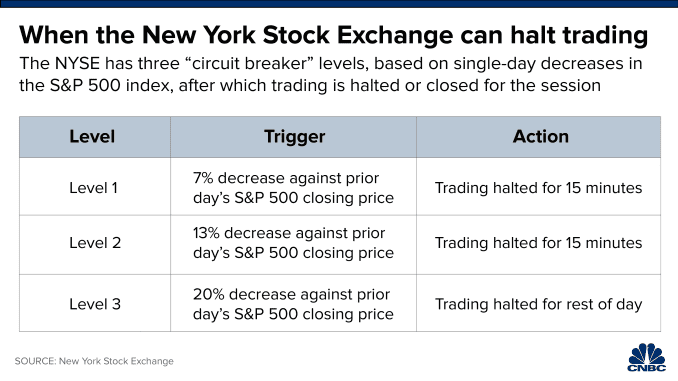

Trading was briefly suspended after a “circuit breaker” was tripped up. A circuit breaker halts trading across the U.S. stock exchanges for 15 minutes and is meant to ensure orderly market behavior. Wednesday marked the fourth time in a week that a circuit breaker was triggered.

Details of a potential fiscal stimulus package were not enough to curb the selling pressures in the market.

Dow Jones reported on Wednesday the Treasury Department is proposing two rounds of direct payments to citizens, which total $250 billion. Those payments, according to the report, would begin April 6. Treasury is also asking permission to backstop money markets, according to the report. A source familiar with the matter told CNBC on Tuesday the administration is seeking a stimulus package worth between $850 billion and more than $1 trillion.

The number of confirmed U.S. coronavirus cases has jumped to more than 6,400, according to data from Johns Hopkins University, while the death count has broken above 100.

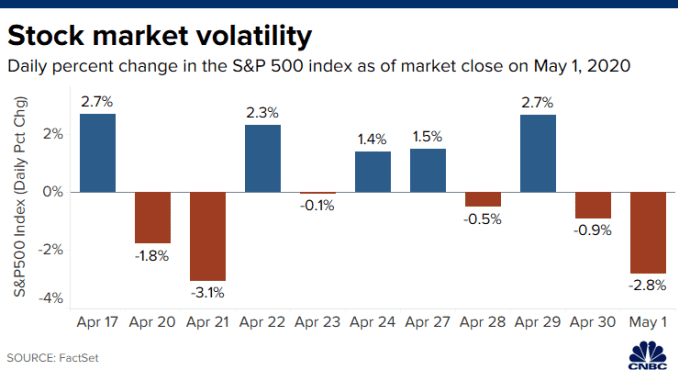

Wall Street has been on an unprecedented roller-coaster ride amid the coronavirus turmoil, with the S&P 500 swinging 4% or more in either direction for a record eight consecutive sessions. This tops the previous record of six days from November 1929, according to LPL Financial.

“Volatility is not over yet,” said Tom Essaye, founder of The Sevens Report, in a note. He pointed out the administration’s stimulus packages need congressional approval. “We also need to see more progress on the pharma side of things, and above all else we need the growth rate of the virus to peak in the coming weeks.”

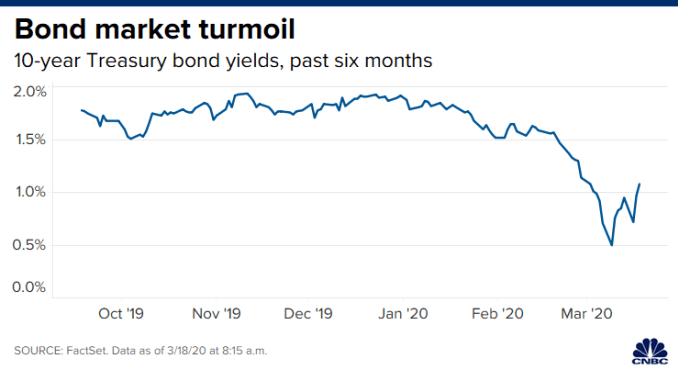

A violent reversal in Treasury yields in response to a potential $1 trillion stimulus package helped to unnerve investors as well on Wednesday.

The 10-year Treasury yield jumped to 1.21% Wednesday after trading around 0.77% midday Tuesday before details of the potential stimulus emerged. It began the week at around 0.65%. It wasn’t the outright rate level that caused uneasiness among traders, but the rapid nature of the move overnight.

“When you decimate the restaurant industry, the travel industry, the hotel industry, the airline industry .. the cruise line industry, obviously you’re going to take a huge divot out of economic activity,” DoubleLine Capital CEO Jeffrey Gundlach said on a webcast Tuesday after the bell. Gundlach put the odds of a recession at 90% and said it was “ludicrous” to think otherwise. He added he believes the stimulus will end up being even bigger than $1 trillion.

Gundlach also commented on the reversal higher in Treasury yields, noting it could put the U.S. in the uncomfortable position of having both a weak economy and rising rates, as new debt issuance to pay for the stimulus floods the bond market.

But despite the relentless selling pressures in the market, legendary investor Bill Miller thinks this is an “exceptional buying opportunity.”

“There have been four great buying opportunities in my adult lifetime,” Miller told CNBC’s Kelly Evans on “The Exchange.” “The first was in 1973 and ’74, the second was in 1982, the third was in 1987 and the fourth was in 2008 and 2009. And this is the fifth one.”

Tiếng Việt

Tiếng Việt 普通话

普通话